Myanmar News Updated

Highlight Myanmar News

CEO Survey 2019 Indicates Skills Gap in Region

![]() 09/04/2019

09/04/2019

AUTHOR: ZIN THU TUN

The 2019 edition of the Business Barometer: ASEAN CEO Survey carried out by Oxford Business Group (OBG) indicates that executives across the region remain largely upbeat about the economic outlook, although skills gaps risk preventing some member states from reaching their full potential.

As part of its survey on the economy, the global research and consultancy firm asked more than 400 C-suite executives from across industries in Thailand, Indonesia, the Philippines and Myanmar a wide-ranging series of questions on a face-to-face basis aimed at gauging business sentiment.

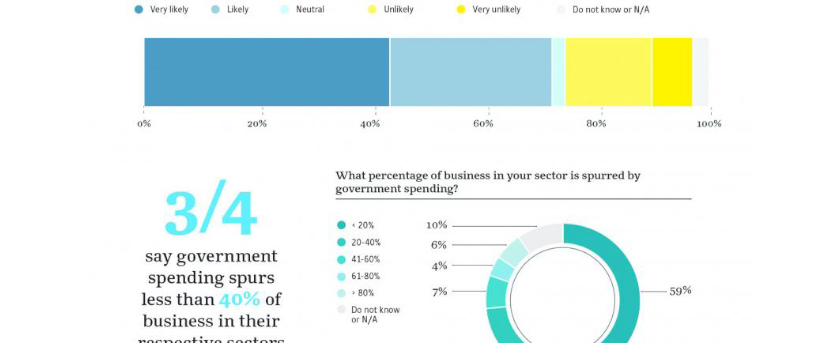

Investor sentiment appears to be largely buoyant across the four participating countries, with 75% of respondents saying their firm is likely or very likely to make a significant capital investment in the next 12 months. Confidence was highest amongst business leaders in Thailand (81%) and lowest in Indonesia (72%).

Results were more varied, however, on key domestic issues, such as the competitiveness of the local tax environment. Just 38% of CEOs surveyed told OBG they believed their tax framework to be competitive or very competitive, while 45% described it as uncompetitive or very uncompetitive. Executives in the Philippines were the most critical, with less than one-quarter (23%) of Manila-based respondents expressing a favourable opinion of their domestic tax environment.

Access to credit was another subject that drew mixed responses, with 39% of interviewees across all four participating members of the bloc describing it as easy or very easy, but a larger number (46%) choosing the opposite answers. While business leaders in Thailand and the Philippines were largely favourable in their views, the overall result was skewed by responses from Myanmar, where more than four-fifths (81%) of executives described accessing credit as difficult or very difficult.

With several ASEAN economies eyeing tech industries and advanced manufacturing as drivers of new growth, skills gaps are currently a key focus for CEOs in the region. Executives cited a range of skills as among those they felt to be in high demand across the workforce, led by leadership (33%), engineering (18%), and research and development (14%).

Unsurprisingly, a slowdown in Chinese demand was the biggest external concern to business leaders. From those surveyed, 28% cited this as the largest international threat to domestic growth, closely followed by trade protectionism (26%) and rising commodity prices (20%).

Commenting in his blog, Patrick Cooke, OBG’s Regional Editor for Asia, said that despite China’s influence in the region, there are reasons to believe that ASEAN can remain resilient to external pressures on its interests.

“Closer economic integration and trade linkages between the bloc of over 600m people can help safeguard against turmoil in the global economy, as well as providing the scale needed to commercialise new innovations that can address development bottlenecks,” he noted.

Cooke added that mixed results on questions related to the domestic business climate in the four countries surveyed reflected significant differences in domestic regulatory frameworks, despite efforts to strengthen integration, in line with the ASEAN Economic Community 2025 blueprint. He also noted that a lack of depth in the talent pool across all member states could hinder future economic development unless skills shortfalls are addressed.

“Despite challenges in the business environment, however, investor sentiment remains enthusiastic across the participating countries,” he said. “The broadly positive results indicate that ASEAN’s potent mix of aspirational consumers, digital natives and abundant natural resources continue to hold the promise of high returns.”

Related News

-

Exclusive Interview with ZTE Myanmar CEO

AUTHOR: NICHOLAS ONEGA Headquartered in China, and established 1985, ZTE is one of the largest equipment providers in the country. ZTE provides equipment and services needed for high-speed internet across the global. In addition to supplying equipment and services for the Myanmar telecom market, ZTE has been paying much attention to their Corporate Social Responsibility (CSR) and making efforts to contribute to the Myanmar communities. One of these developments is the Campus Shining Project, created to enhance the education and growth of the youth in Myanmar. With some of the largest universities in Yangon and Mandalay already on board.

Read More 09/04/2019

09/04/2019 -

5 Key Potential Investment Sectors for Thai Investors

Author : Nattawin Phongsphetrarat, vice president of Thai Business Association of Myanmar (TBAM). " One of the very famous questions that has always been asked by the Thai investors for Myanmar is what the high potential business sectors are for Thai business. " There are many sectors that have high potential but TBAM committees have analyzed that these 5 sectors are the key potential

Read More 08/04/2019

08/04/2019 -

Interview: Nokia’s CSO to Myanmar Discusses 5G

AUTHOR: SWE LEI MON Telecommunication technology has advanced from 3G to 4G, and now 5G is making a lot of waves in the sector. Experts believe that the world is shifting to 5G. At this exciting time in technology advancement, an interesting question to ask is: Can Myanmar, which just joined the “mobile dance” in 2014, successfully transition to 5G along with everyone else?”

Read More 12/03/2019

12/03/2019